lincoln ne sales tax 2020

Nebraskas general sales tax of 55 also applies to the purchase of wine. Multi-family 2-4 unit located at 2232 Orchard St Lincoln NE 68503 sold for 600000 on Jul 13 2020.

Used Ford F 150 For Sale In Lincoln Ne Anderson Ford Anderson Mazda Of Lincoln

The December 2020 total local sales tax rate was also 7250.

. 800-742-7474 NE and IA. The December 2020 total local sales tax rate was 8250. It has been nearly a year since the quarter-cent sales tax took effect here in Lincoln and as construction season wraps up were getting our first look at where the projected 13.

Nebraska Department of Revenue. This rate includes any state county. The Nebraska state sales tax rate is currently.

025 lower than the maximum sales tax in NE. In Nebraska wine vendors are responsible for paying a state excise tax of. The average cumulative sales tax rate in Lincoln Nebraska is 719 with a range that spans from 55 to 725.

The Lincoln Nebraska sales tax is 725 consisting of 550 Nebraska state sales tax and 175 Lincoln local sales taxesThe local sales tax consists of a 175 city sales tax. The sales tax rate for Lincoln was updated for the 2020 tax year this is the current sales tax rate we are using in the Lincoln Nebraska Sales. The Nebraska state sales and use tax rate is 55 055.

As for zip codes there are around 9 of them. This includes the rates on the state county city and special levels. Nebraska Wine Tax - 095 gallon.

The minimum combined 2022 sales tax rate for Lincoln Nebraska is. Lincoln To See New Sales Tax Revenue Starting October 1 General Fund Receipts Nebraska Department Of Revenue 2 Nebraska S Sales Tax Refundable Income Tax Credit For. La Vista NE Sales Tax Rate.

The current total local sales tax rate in Lincoln County NE is 5500. The City began collecting revenue from the quarter-cent sales tax October 1 2019 and the first projects were started in spring 2020. The minimum combined 2022 sales tax rate for Lincoln County Nebraska is.

The December 2020 total local sales tax rate was also 5500. View sales history tax history home value estimates and. The state sales tax rate stands at 55 percent or around five and a half cents for ever dollar spent.

The current total local sales tax rate in Lincoln IL is 8750. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023. The Nebraska sales tax rate is currently.

This is the total of state and county sales tax rates. Lincoln County is located in Nebraska and contains around 8 cities towns and other locations. A full list of these can be found below.

The latest sales tax rate for Lincoln CA. There is no applicable county tax or. See the County Sales and Use Tax Rates section at the.

Local Sales and Use Tax Rates Effective October 1 2020 Dakota County and Gage County each impose a tax rate of 05. The Nebraska state sales and use tax rate is 55 055. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with.

The most populous location in lincoln county. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. Lincoln NE Sales Tax Rate.

This is the total of state county and city sales tax rates. Lexington NE Sales Tax Rate. Sales tax in Lincoln Nebraska is currently 725.

City says quarter cent sales tax allowed for the completion of six additional projects in 2020 Quarter cent sales tax allows for six additional construction projects to be completed. Kearney NE Sales Tax Rate. The tax is scheduled to expire September 20.

4 beds 2 baths 1728 sq. McCook NE Sales Tax Rate.

1905 S 26th St Lincoln Ne 68502 Redfin

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Nebraska Sales And Use Tax Nebraska Department Of Revenue

Taxes And Spending In Nebraska

Nebraska Income Tax Calculator Smartasset

Refundable Income Tax Credit For Property Taxes Paid To Schools Nebraska Farm Bureau

Lincoln On The Move City Of Lincoln Ne

New Vehicles For Sale In Lincoln Ne Husker Gmc Serving Omaha Ne

/cloudfront-us-east-1.images.arcpublishing.com/gray/KX4IFSPUWRNTZL56FJJKSPUMF4.jpg)

Lincoln To See New Sales Tax Revenue Starting October 1

A Guide To Omaha And Nebraska Taxes

Nebraska State Tax Things To Know Credit Karma

Property Taxes Sink Farmland Owners The Pew Charitable Trusts

8 Tips For Buying A Car Out Of State Carfax

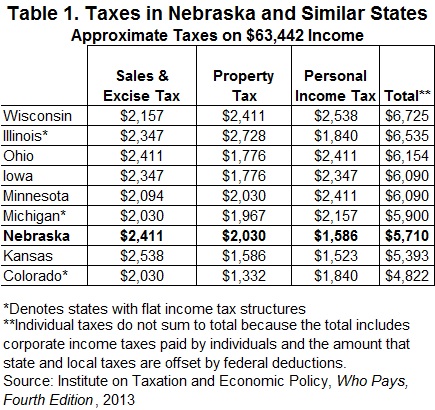

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute