what is suta tax rate for 2021

Skip to Content. FUTA Tax Rates and Taxable Wage Base Limit for 2022.

2022 Suta Taxes Here S What You Need To Know Paycom Blog

Schedule D Reference Wisconsin Statute 10818 Taxable wage base 14000.

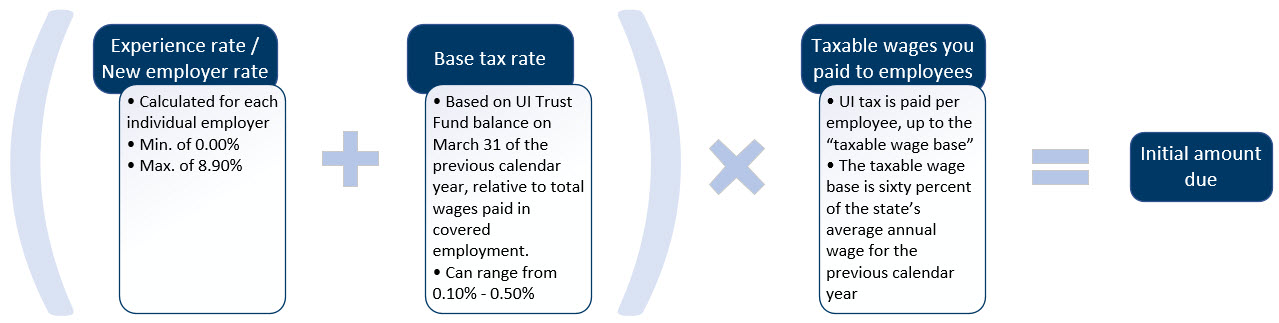

. December 15 2021. Taxable base tax rate. Lets say your business is in New York where the lowest SUTA tax rate for 2021 was 2025 and the highest was 9825 and youre assigned a rate of 4025.

24 new employer rate Special payroll tax offset. For example in 2022 employers in the best positive-rate class were assigned a tax rate of 0207 percent and would pay only 9625 for each employee who makes at least the 2022 wage base. July 1 2019 to.

State and Federal Unemployment Taxes. The minimum and maximum tax rates for wages paid in 2022 are as follows based on annual wages up to 7000 per employee. The legislation sets the unemployment tax rates for 2022 and 2023 to be determined under Table C rather than Table F as they were for tax year 2021.

Mail Date for Unemployment Tax Rate Assignments For 2022. Businesses and employees will face a variety of difficulties. General employers are liable if they have had a quarterly payroll of 1500.

July 1 2020 to June 30 2021. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. The FUTA tax rate protection for 2021 is 6 as per the IRS standards.

Current Tax Rate Filing Due Dates. There are seven federal income tax rates in 2023. The new employer SUI tax rate remains at 34 for 2021.

As a result of the ratio of the California UI Trust Fund and the total wages paid. In November of each year active employers will be mailed an Unemployment Tax Rate Assignment Form. Unemployment tax rates for employers subject to Oregon payroll tax will move to tax schedule three for the 2022 calendar year.

The Ohio SUI tax rate ranges from 08 to 99 in 2021 up from a previous tax rate range of 3 to 91 in 2020. If the Office of UC Tax Services issues a denial of a contribution rate appeal the employer has the right to file a second-level appeal with the UC Tax Review Office. 0010 10 or 700 per.

The FUTA tax rate is 6 of the first 7000 of wages though many businesses qualify for a tax credit that lowers it to 06. Employers are liable for unemployment tax in Virginia if they are currently liable for Federal Unemployment Tax. Employers with a zero rate are still required to file quarterly contribution and wage reports.

What is the SUTA tax rate for 2021. For the 2021 tax year the bracket ranged. Most businesses also have to comply with their.

The 2022 payroll tax schedule is a modest shift down from. Employers pay two types of unemployment taxes. 2021 to June 30 2022.

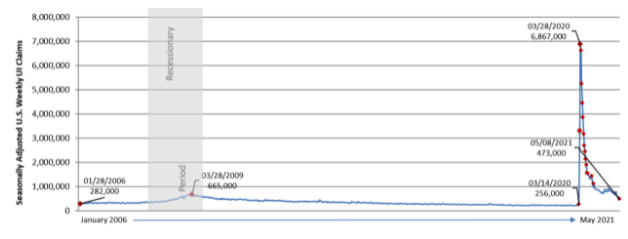

One based on normal experience that includes fiscal years 2020 and 2021. You can get tax rate information and a detailed listing of the individuals making up the three-year total of benefit chargebacks used in your Benefit Ratio online or by phone fax. State unemployment taxes are paid to this Department and.

The FUTA tax applies to the first 7000 of. Tax rates under Table C range from 10. 1 day agoAlthough the federal tax rates didnt change the tax bracket income ranges for the 2023 tax year are adjusted to account for inflation.

State unemployment tax rate information for Kansas employers. Unemployment Tax Rates. The first rate is based on the fiscal years 2017 2018 and 2019 and the second rate is based on the fiscal years 2019.

What Is Suta Tax Definition Rates Example More

Ultimate Guide To Sui And State Unemployment Tax Attendancebot

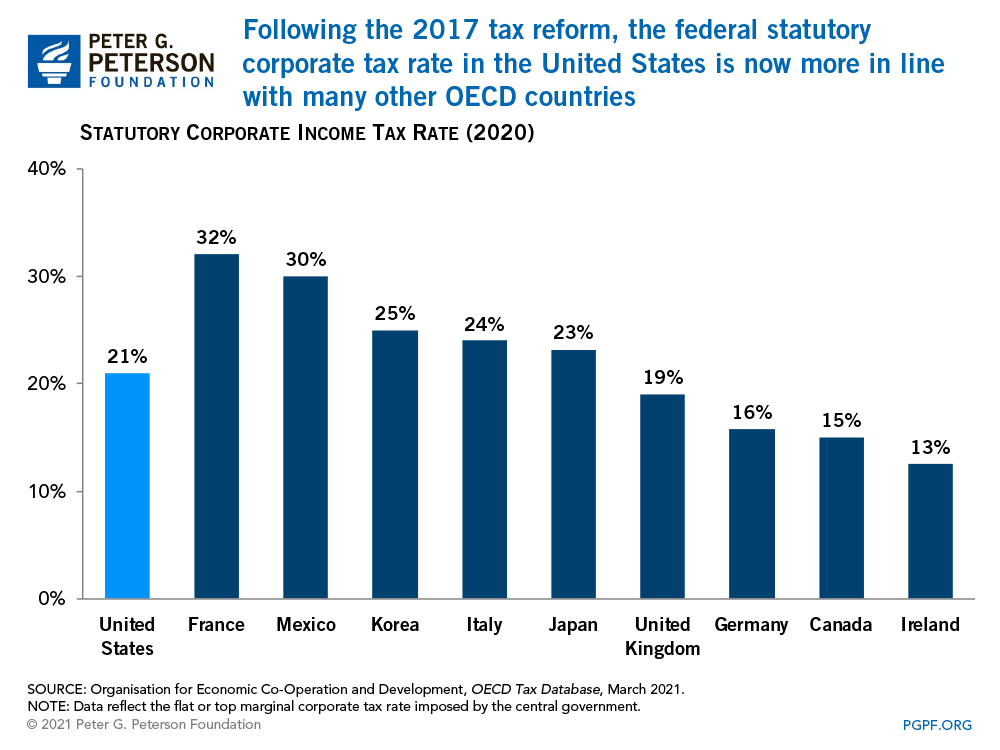

/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-02-2d1d9e3a2450426893a7cb627c44baf9.jpg)

Countries With The Highest And Lowest Corporate Tax Rates

Unemployment Tax Rates Employers Unemployment Insurance Minnesota

What Are Employer Taxes And Employee Taxes Gusto

2021 State Business Tax Climate Index Tax Foundation

2021 State Unemployment Insurance Tax Climate Index 501 C Services

Six Charts That Show How Low Corporate Tax Revenues Are In The United States Right Now

Business Owners Optimistic Following Increased Unemployment Tax Rate Wuft News

View All Hr Employment Solutions Blogs Workforce Wise Blog

Year End Tax Information Applicants Unemployment Insurance Minnesota

2021 Federal Payroll Tax Rates Abacus Payroll

![]()

2022 Annual Tax Rate And Benefit Charge Information Division Of Unemployment Insurance

How High Are Your 2021 Unemployment Taxes Nfib

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

Japan Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical